Choose Your Course

Sage 50 Cloud Pastel

Course 1 :Beginnger

Course Overview:

This comprehensive training programme covers the basic bookkeeping terms and concepts. This also shows how to deal with basic bookkeeping documents and how to use them in a manual paper based accounting system.

Target Learners:

This course has been designed for learners who are required to work with accounts, and who have had little or no exposure to bookkeeping.

What you will learn:

Bookkeeping Introduction,

Value Added Tax (VAT),

Source Documents,

Inventory,

Subsidiary Journals,

The General Ledger,

The Trial Balance,

The Statement of Income,

The Statement of Financial Position, and

Bank Reconciliation.

Study methods:

• Facilitated Classroom

• Virtual Classroom

The assessment is done online.

A stable internet connection is required to access the virtual classroom and exam.

Send me an enquiry for pricing and availability via contact us or email address below.

Sage 50 Cloud Pastel - Intermediate

Course 2: Practitioner Intermediate

Course overview:

This comprehensive training course will give you the knowledge and skills necessary to perform a bookkeeper to trial balance function using Sage 50cloud Pastel Partner.

Course pre-requisites:

Bookkeeping Fundamentals.

Computer Literacy at NQF Level 3 or Standard 8/Grade 10 Computer Literacy.

Mathematical Literacy or Standard 8/Grade 10 Mathematics.

What’s covered in the course:

Installation

Working in the demo company

Creating a new company

Auto setup.

Edit master files.

Supplier processing.

Cash book processing.

Customer processing.

Customer journals.

Monthly processing.

Take on balances.

Study methods:

• Facilitated Classroom

• Virtual Classroom

The assessment is done online.

A stable internet connection is required to access the virtual classroom and exam.

Send me an enquiry for pricing and availability via contact us or email address below.

Sage 50 Cloud Pastel - Advanced

Course 3: Practitioner: Advanced

Course Overview:

This comprehensive training course will give you the knowledge and skills necessary to utilize the advanced features of Sage 50cloud Pastel Partner.

Course pre-requisites:

Sage 50c Pastel Intermediate.

What’s covered in the course:

Advanced Functions in the File Menu.

Advanced Customer Functions.

Advanced Functions.

Advanced Supplier Functions.

Advanced Functions in the Change Menu.

Advanced Functions in the Utility Menu:

1. Control center.

2. Microsoft Office integration.

Other Advanced Functions:

1. Forms designer.

2. Inventory selling price adjustment.

Study methods:

• Facilitated Classroom

• Virtual Classroom

The assessment is done online.

A stable internet connection is required to access the virtual classroom and exam.

Send me an enquiry for pricing and availability via contact us or email address below.

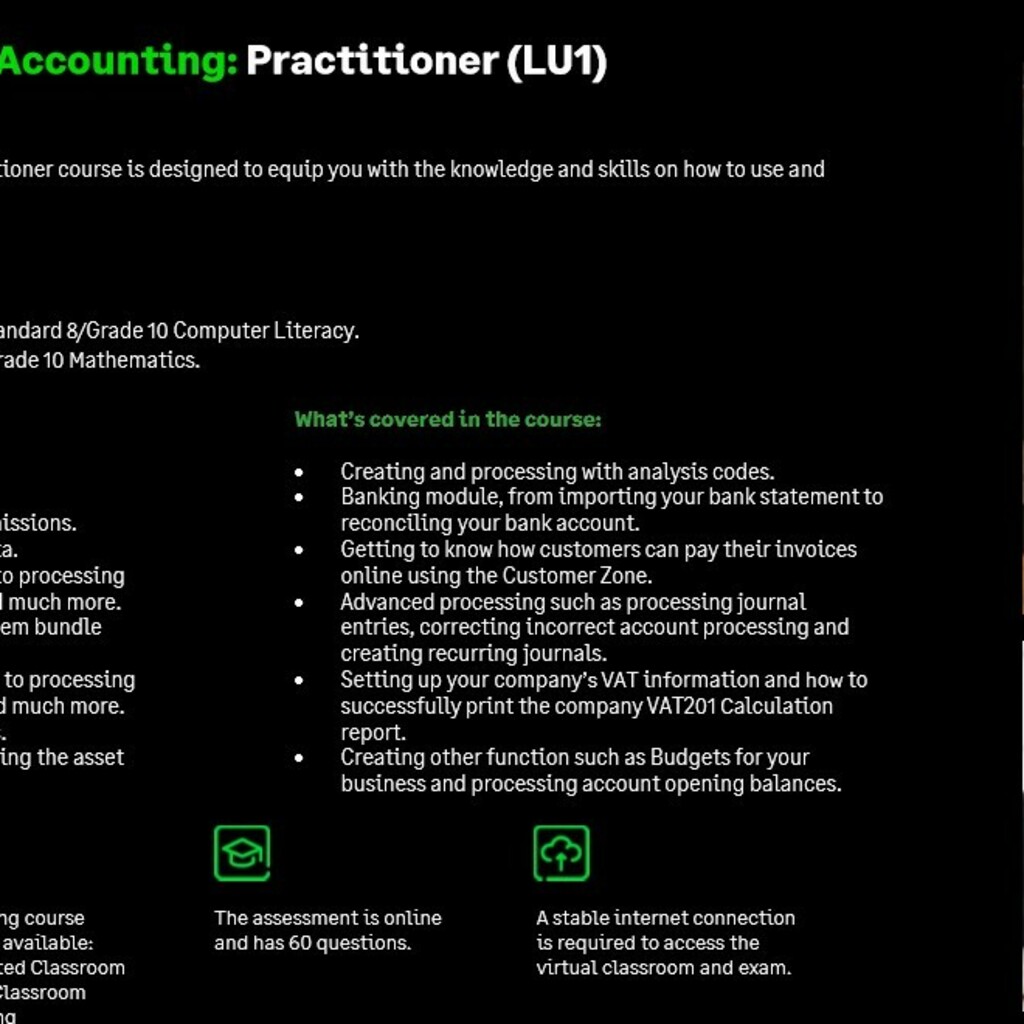

Sage Accounting Practitioner course

Overview:

The Sage Accounting Practitioner course is designed to equip you with the knowledge and skills on how to use and implement the Sage Accounting software.

What you will learn:

Getting Started with the software.

Navigating within the software.

Creating users and assigning user permissions.

Exporting and importing Masterfile data.

Everything to do with suppliers, from setting up Masterfile to processing documents such as Purchase Orders and much more.

Everything to do with your inventory items including setting up item bundle transactions.

Everything to do with customers, from setting up masterfiles to processing documents such as quotes, invoices and much more.

Creating bank and credit card accounts.

Creating your company assets and running the asset register report.

Creating system accounts, sales & purchase accounts and grouping your accounts using the Account Reporting Groups feature.

Creating and processing with analysis codes.

Everything to do with the Banking module from importing your bank statement to reconciling your bank account.

Getting to know how customers can pay their invoices online using the Customer Zone.

Advanced processing such as processing journal entries, correcting incorrect account processing and creating recurring journals.

Setting up your company’s VAT information and how to successfully print the company VAT201 Calculation report.

Creating other function such as Budgets for your business and processing account opening balances.

Duration: This is a 14 hour course.

Exam and Certification: The assessment is done online, If the assessment is completed successfully (75% and higher), you will earn a Sage Accounting Certified Practitioner status.

Send me an enquiry for pricing and availability via contact us or email address below.

Other courses offered as follows:

Accounting:

Sage 200 Evolution

Sage 300 Accounting

X3

Bookkeeping Fundamentals

Excel:

Essentials / Intermediate / Steroids / Steroids Plus

Payroll and HR

Send me an enquiry for pricing and availability via contact us or email address below.